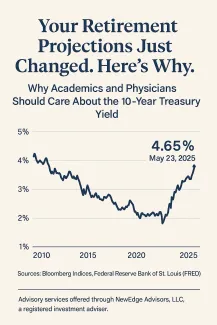

Your Retirement Projections Just Changed. Here's Why.

Why Academics and Physicians Should Care About the 10-Year Treasury Yield

A Quiet Shift with Loud Implications

As of May 23, 2025, the yield on the 10-year U.S. Treasury sits at 4.66%. That may sound like trivia if you don't follow markets. But it's not.

If you're a professor relying on a TIAA plan, or a physician with a 403(b) and a carefully structured retirement strategy, this number has already affected your future—even if no one has told you yet.

And for institutions—medical groups, private colleges, and research universities—it's more than a headline. It's a budget constraint.

A Colleague's Wake-Up Call

A senior faculty member I work with recently asked why his projected retirement income looked 15% lower than expected. Nothing had changed in his contributions or target retirement date—except the Treasury yield.

When we reran his annuity quotes and drawdown models at today's rates, the outcome was materially different. And more importantly, permanent.

That's what this piece is about.

How We Got Here: A Quick History of the "Risk-Free Rate"

- In the 1980s, 10-year Treasury yields were over 10%.

- In the 1990s and early 2000s, they ranged from 4% to 6%.

- From 2009 to 2021, they dropped below 2.5%, fueling a decade of low borrowing costs and optimistic planning assumptions.

That era is over. If your financial strategy still assumes we're going back, you're planning for a world that no longer exists.

Why This Rate Affects Everything You Rely On

The 10-year Treasury yield is the cornerstone of modern finance. When it rises, it shakes the foundation.

- Endowment Spending: A 2% increase in the discount rate can reduce a mid-sized university's projected payouts by millions annually.

- Department Budgets: Higher debt costs mean deferred hires, frozen projects, and grant-match cancellations.

- Medical Practices: That MRI you planned to finance at 3.5%? It now costs 6.25%—changing your investment logic.

According to the Yale Budget Lab:

"When interest rates move, the long-term math for research institutions moves with them."

And for individuals:

- Retirement Annuities: Payouts tied to Treasury yields shift with even modest changes.

- Bond Portfolios: Long-duration holdings from 2020–2021 may still be underwater.

- Cash Reserves: Leaving large balances in accounts earning 0.01% is no longer harmless—it's costly.

Remember the Liz Truss Moment?

In September 2022, UK Prime Minister Liz Truss proposed large tax cuts without offsetting spending. Bond yields soared, pension funds trembled, and she resigned after just 44 days in office.

Here's the relevance: institutions—whether they're nations, universities, or hospital systems—don't get to ignore the cost of capital. When markets lose confidence, the consequences are swift.

The U.S. hasn't had that reckoning yet. But signs are showing—rising borrowing costs, tighter budgets, and donor fatigue are all warning lights.

Five Smart Adjustments to Consider

1. Recalibrate Your Retirement Assumptions

If your plan still assumes 7–8% annual returns, test it against:

- 5% for bonds

- 6–6.5% for equities

This isn't panic. It's precision.

2. Rebalance Fixed Income Exposure

If your portfolio holds bond funds purchased at 1.5% yields, it may be time to rotate into:

- Short-duration Treasuries

- Money markets or high-yield savings earning 4.5–5%

3. Reevaluate Lifetime Income Options

TIAA Traditional and similar fixed annuities are offering higher rates again. If you're 55 or older, now may be a good time to evaluate income guarantees.

4. Stress-Test Capital Planning

If you manage a department or medical practice, model borrowing at 5.5–6%. Some projects still pencil out. Others may not.

5. Get Paid on Idle Cash

If you're keeping large balances in low-yield checking or sweep accounts, explore alternatives. Even 90-day Treasuries may offer safe, meaningful yield.

Final Thought: You Don't Need to Be an Economist—Just Awake

The 10-year Treasury yield isn't just a financial curiosity—it's a planning signal. If you're in a role that involves long-term decisions, now is the time to review your assumptions, ask sharper questions, and take action with intention.

Because the risk-free rate may be rising.

But so is the value of getting this right.

What I'm Watching Next

- The next round of Treasury auctions—and how foreign buyers respond

- Endowment spending adjustments at small private colleges

- How capital-heavy health systems are restructuring their debt

Advisory services offered through NewEdge Advisors, LLC, a registered investment adviser. Advisory services are only offered to clients or prospective clients where NewEdge Advisors and its representatives are properly licensed or exempt from licensure.

This material is for informational purposes only and does not constitute investment, tax, or legal advice. Past performance is not indicative of future results. Investing involves risk and possible loss of principal capital. No advice may be rendered by NewEdge Advisors unless a client service agreement is in place.

California Residents: We take protecting your data and privacy very seriously. As of January 1, 2020, the California Consumer Privacy Act (CCPA) provides additional rights to residents of California. You may view our data privacy statement or exercise your rights here: Do not sell my personal information

Regulatory Resources:

Sources:

- Bloomberg Indices. "U.S. Treasury Benchmark Yields." Data as of May 23, 2025.

- Federal Reserve Bank of St. Louis (FRED). "10-Year Treasury Constant Maturity Rate (GS10)."

- NACUBO. "Endowment Management: Payout Strategies and Planning Implications."

- Bankrate commercial lending data, May 2025.

- Yale Budget Lab. "Institutional Financial Planning Under Rate Pressure."

- BBC News. "Liz Truss Resigns After Chaotic 44 Days in Office." October 2022.

- Vanguard Capital Markets Model Projections (VCMM), 2025.

- Schwab Money Market Fund Rate Sheet, May 2025.

- TIAA. "Traditional Annuity Payout Rates by Contribution Year." Q2 2025.